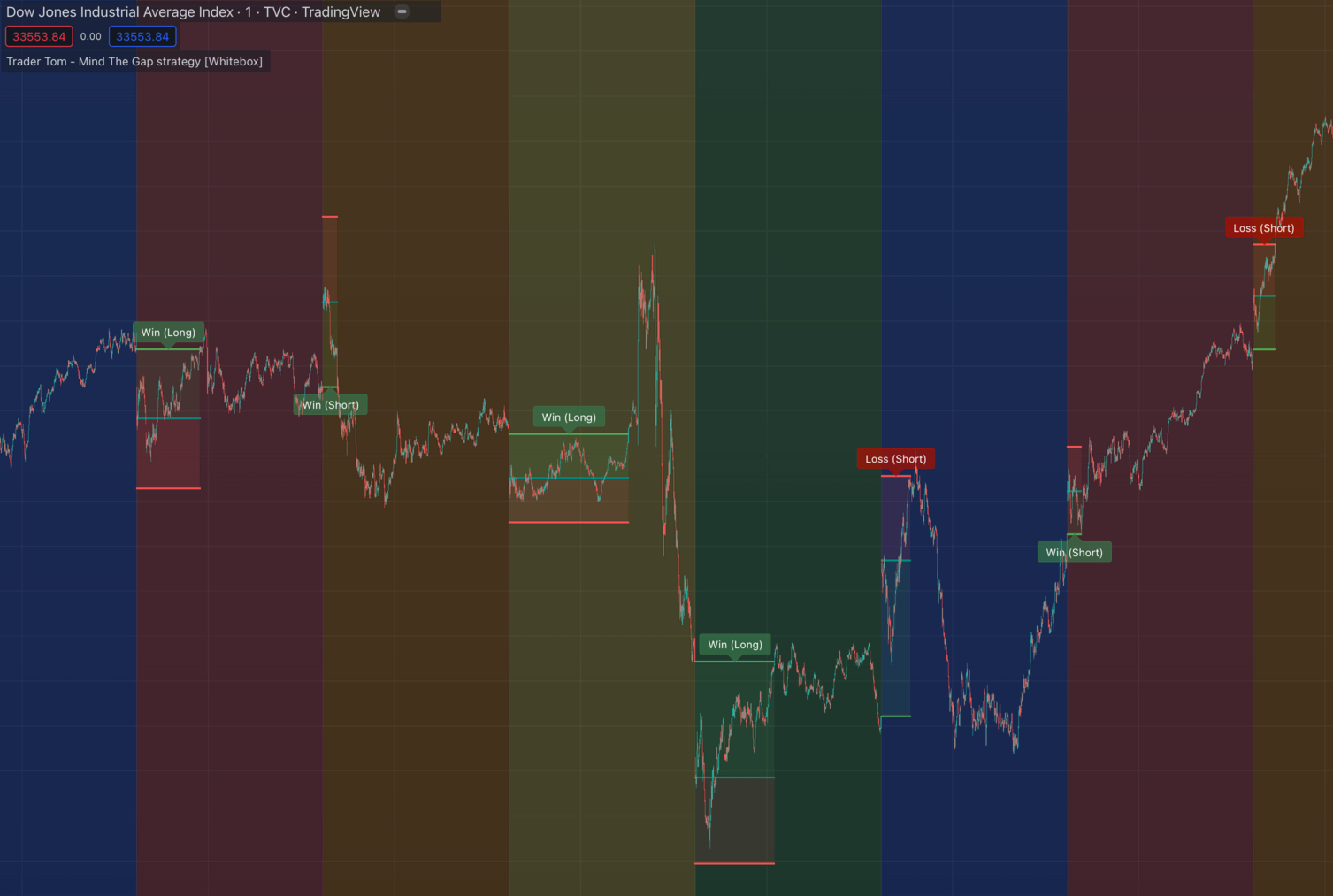

Trader Tom » Mind The Gap strategy

Overview

This is the scripted implementation of Trader Tom's second "scenario-based" trading strategy he described in a talk he gave in London in 2020.

To learn more about the scenario please watch the following video (from 20:22):

Trading Psychology Talk London 2020 by Tom Hougaard Part 2 of 3 - https://www.youtube.com/watch?v=sg_OTc0lRko&t=1222s (all 3 parts are worth watching!)

While Trader Tom did not give concrete instructions on when to enter into a position once the entry criteria is valid, or where to set take profits and stop losses, the strategy script is implemented on top of the Whitebox Strategy Engine, so you are free to experiment with various Entry and Exit strategies.

Settings

This strategy does not use any technical analysis indicators for signalling entries.

Instead it looks at the size of the gap between the previous day's last candle and the current day's first candle, and if it meets the min/max gap size criteria, a position will be opened.

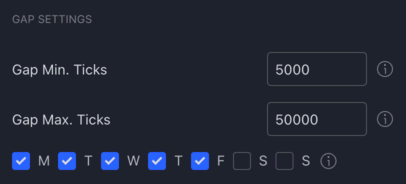

Gap Settings

Gap Min. Ticks

The minimum size of the gap in ticks.

Gap Max. Ticks

The maximum size of the gap in ticks.

Gap days

The days on which you would like the strategy to check for a gap and open a position.

For example, if you have Monday (M) selected, the strategy will check for a gap between the closing price of the 1st candle on Monday, and the high/low price (depending on the trade's direction) on Friday, and if the gap size criteria is met, the strategy will open a position.

Ideally, it really should be the opening price on Monday used for comparison, and not the closing price of the 1st candle, but unfortunately, on historic candles TradingView does not allow scripts to assess the entry criteria & open a position on the opening price of a candle. Because of this we are forced to wait for the 1st candle to close before we can submit our request to open a position. The way to "work around" this limitation, is to set your chart timeframe really low (ideally 1 minute), so by not taking on a position immediately on the 1st candle open, you are not losing out by that much (only 1 minute).

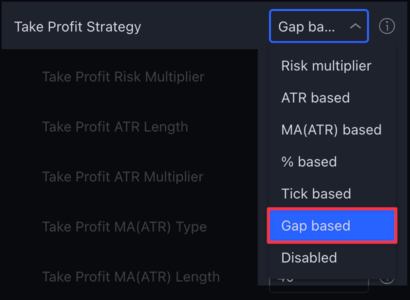

Position Exit settings

Take Profit

The idea that is being tested with this strategy, is whether a gap closes during the day. So, it would kind of make sense to use a take profit strategy that places the take profit to the high/low of the previous day's final candle.

In order to support this, we had to introduce a strategy specific take profit strategy: Gap based

When the Gap based take profit strategy is selected, the take profit will be calculated as per the following.

Long positions

Assume we are currently at the close of the first candle on Tuesday. Both the opening and the closing price of this candle is well below the final candle that printed on Monday, so an entry will be made.

The strategy looks at the low of the final candle on Monday, and will use that as the level to place the take profit at.

Why? Because once the low of that candle is reached, we have essentially closed the gap.

Short positions

Assume we are currently at the close of the first candle on Friday. Both the opening and the closing price of this candle is well above the final candle that printed on Thursday, so an entry will be made.

The strategy looks at the high of the final candle on Thursday, and will use that as the level to place the take profit at.

Why? Because once the high of that candle is reached, we have essentially closed the gap.

Stop Loss

By default the strategy uses the Reward multiplier stop loss strategy with the multiplier set to 1, resulting in a 1:1 Risk/Reward ratio for each trade.

You are encouraged to experiment with other stop loss strategies to see if they work better.

Visuals

Background colour

- Red: Monday

- Orange: Tuesday

- Yellow: Wednesday

- Green: Thursday

- Blue: Friday

- White: Saturday

- Purple: Sunday

This can be turned on/off via:

Day of the week labels

At the bottom of the chart, for each bar the strategy will display the day:

This can be turned on/off via:

What's with the name?

Trader Tom is a UK based trader, so naturally, a strategy involving gaps could't be named anything else!